S&P 500 and Nasdaq 100 Latest – Bearish Sentiment Prevails Ahead of the Fed

S&P 500 AND NASDAQ 100 – TECHNICAL FORECASTS AND ANALYSIS

- S&P 500 continues to respect the longer-term downtrend.

- Nasdaq 100 looking to invalidate a month-old bull flag formation.

S&P 500 AND NASDAQ 100 – TECHNICAL FORECASTS AND ANALYSIS

- S&P 500 continues to respect the longer-term downtrend.

- Nasdaq 100 looking to invalidate a month-old bull flag formation.

Most Read: S&P 500, Nasdaq Technical Outlook – Long-Term Downtrend Meets Short-Term Uptrend

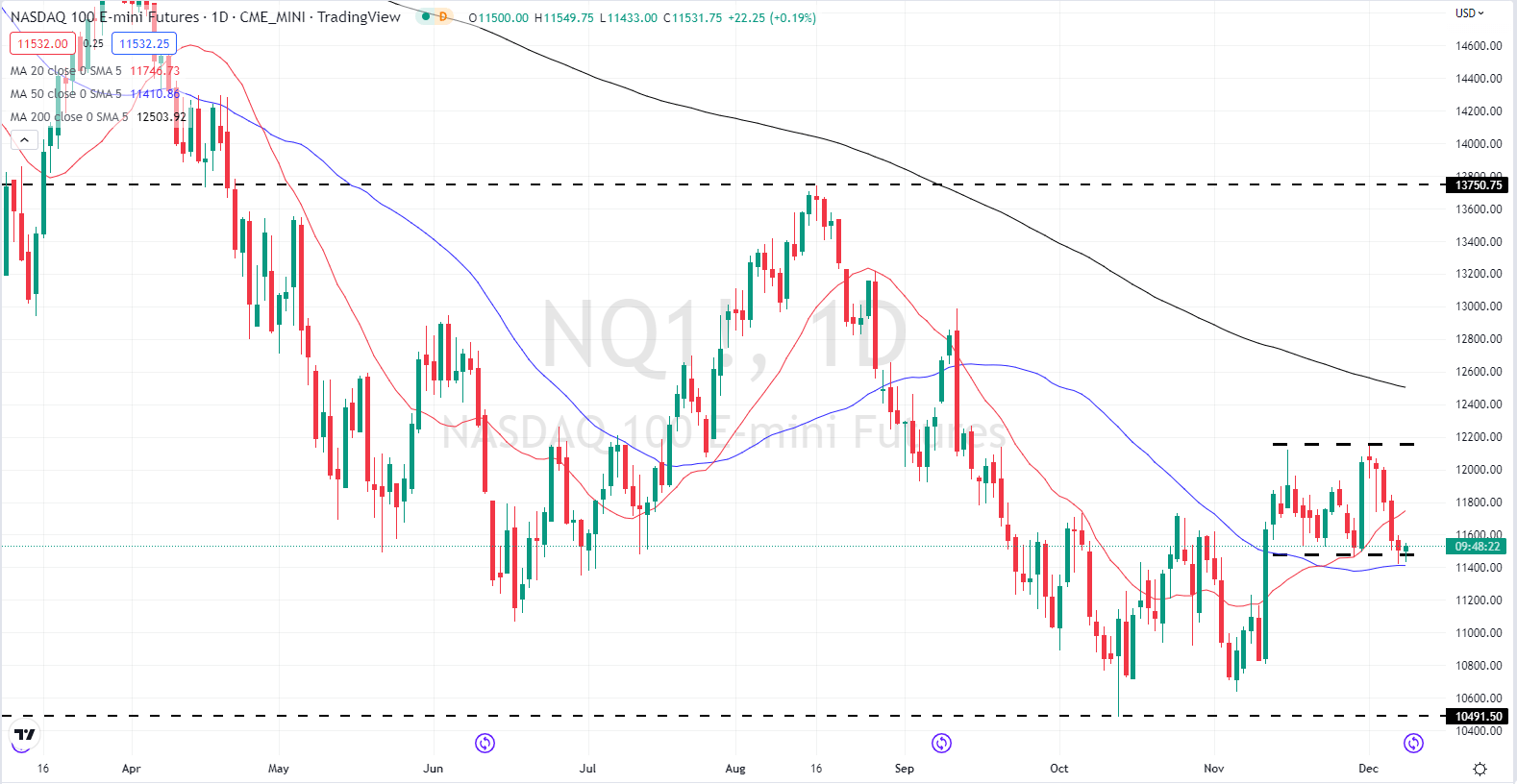

The S&P 500 made a notable break lower on Tuesday, failing to hold onto the recent trend support, the 20-day moving average, and the psychological level at 4,000. All these indicators now turn to short-term resistance, blocking the way for the indices to move appreciably higher. Traders are now expected to move towards the sidelines until next week’s main event, the FOMC policy decision on Wednesday. The Federal Reserve is expected to increase rates by 50 basis points - after having hiked rates by 75 basis points at the last four meetings – and will give the markets their latest thoughts on inflation, growth, and the labor market. Next week’s press conference by Fed chair Jerome Powell will hold the key to market direction going into the year-end.

S&P 500 DAILY PRICE CHART – DECEMBER 8, 2022

CHANGE IN LONGS SHORTS OI DAILY 0% 2% 1% WEEKLY 36% -10% 10% Retail trader data shows 53.75% of traders are net-long with the ratio of traders long to short at 1.16 to 1.The number of traders net-long is 3.78% higher than yesterday and 40.45% higher from last week, while the number of traders net-short is 0.43% higher than yesterday and 12.35% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests US 500 prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger US 500-bearish contrarian trading bias.

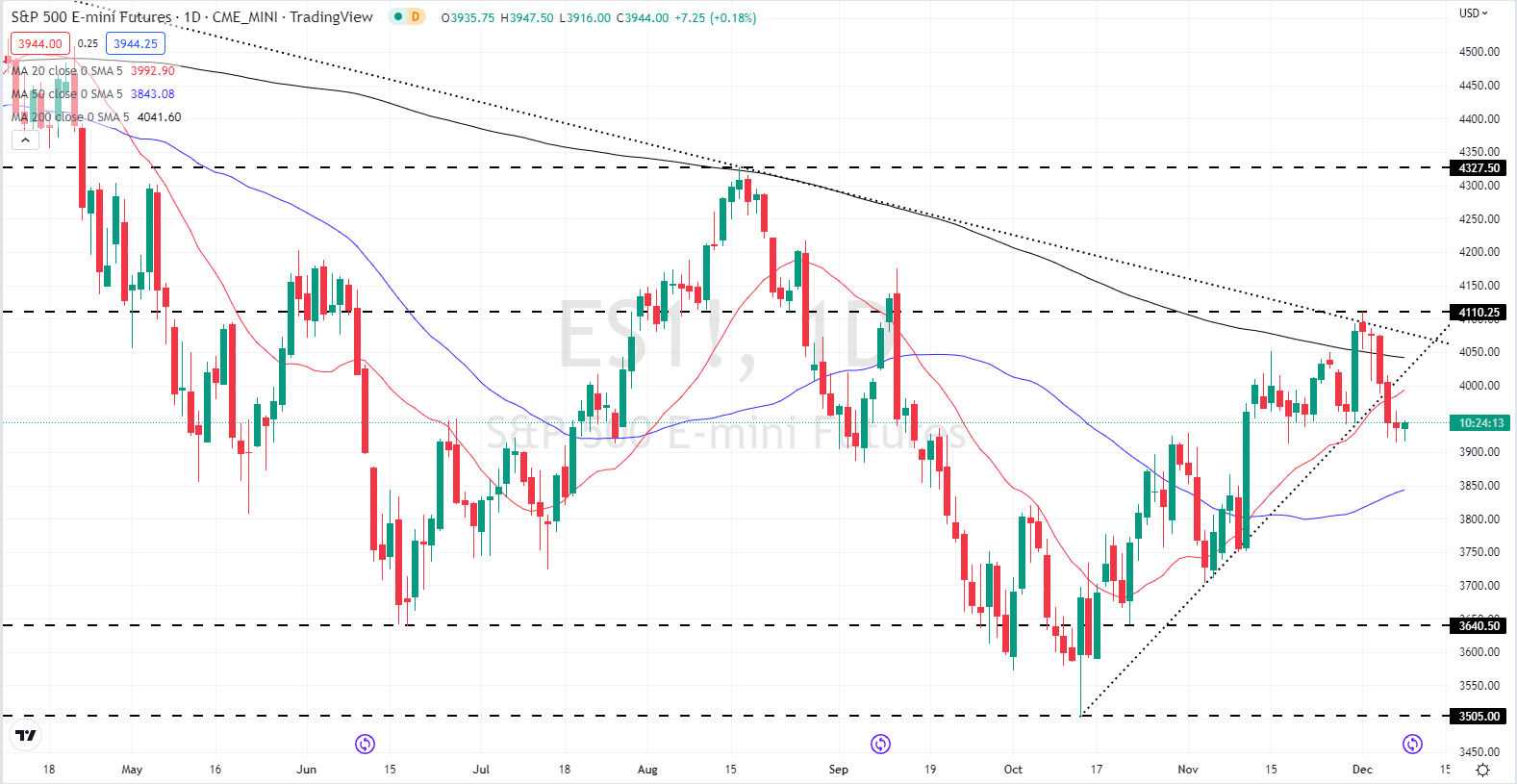

The Nasdaq 100 is trading at a fresh two-week low and is struggling to hold onto a month-old bullish flag formation. Recent data suggesting that the US economy is holding up better than expected has pushed interest rate hike expectations higher, damaging the tech sector. A break lower and back below the 50-dma could open the way for the Nasdaq to retrace all of the November 10 candle back down to 10,808. As with the S&P, next week’s Fed decision will be key.

NASDAQ 100 DAILY PRICE CHART – DECEMBER 8, 2022